block input tax malaysia list

But there are some cases where ITC is blocked so that recipient is not able to claim ITC. The registered manufacturer is allowed to claim for input tax on the stock in hand in.

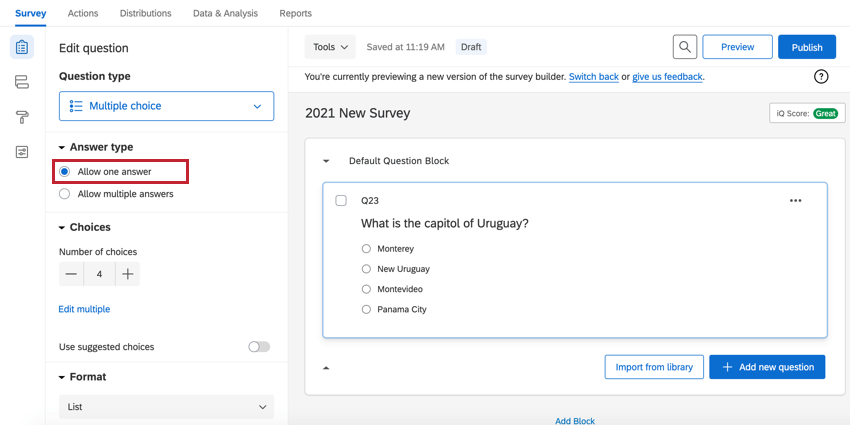

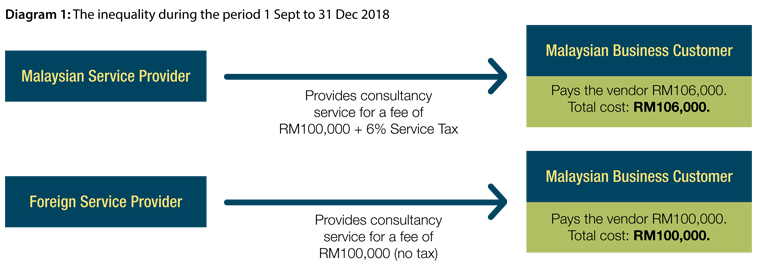

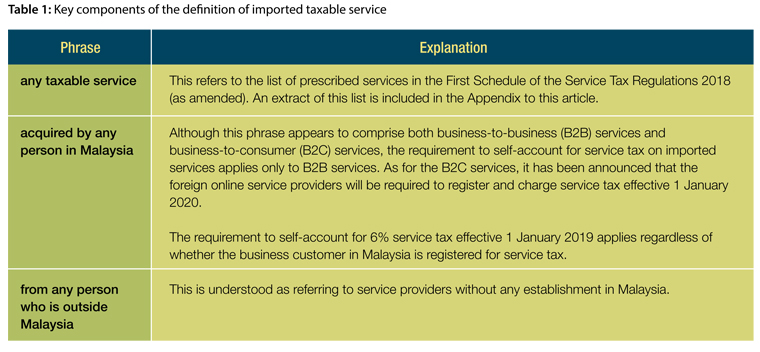

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

Bhd a GST registered International Procurement Center undertakes procurement and sale.

. The goods or services. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones. It is further guided based on Regulation to prescribe on the items that are excluded.

1 The supply to or importation by him of a passenger motor car. RM150000 RM4000 ii The garment manufacturer is entitled to claim input tax since the value of exempt supplies is less than RM5000 per month and does not exceed 5 of the total value of all supplies. Senin 09 Agustus 2021.

Home Unlabelled Block Input Tax Malaysia List - Income Tax Fundamentals 2017 with HR Block Premium. The HR Block Tax File and Prep app provides many of the same features as the other apps on this list. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns.

Journal Entry 39 9. Blocked input tax refers to input tax credit that you cannot claim. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

Sales tax is a single stage tax charged and levied on all taxable goods manufactured in or imported into Malaysia. Generate GST Return File 44 94. Imposition of Sales Tax 4.

You can claim input tax incurred on your purchases only if all the following conditions are met. Blocked credit list Section 175 1. Section 175 of GST Act deals with the blocking of ITC on specified inward supplies.

Capital goods purchased from GST registered suppliers and directly attributable to taxable supplies. INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No. GST incurred at 6.

A specific Sales Tax rate eg. 12017 Date of Publication. Cash Payment Blocked input tax 38 84.

030 Malaysian ringgits MYR per litre is applicable. Stamp atx 65 Specific tax on certain merchandise and services 66 Public lighting tax 67. Blocked input tax however means input tax credit that business cannot claim.

GST exemptions apply to the provision of most financial services the supply of digital. VAT ccaul olaint 55 Block input VAT 60 Other taxes 61. ITC is used for payment of output tax.

For GST Malaysia there are 3 types of supply. Sales Tax is charged at 10 on the value of the goods removed. In other countries GST is known as the Value-Added Tax or VAT.

According to the DG decision 42014 amended 28 October 2015 1 GST shall be charged by a taxable person in the course or furtherance of business on any taxable supply of goods or services made in Malaysia section 9 GSTA. By far online payment is the easiest and most efficient way to pay income tax in Malaysia. The best would be via the IRBs own online platform ByrHASILIts the only online platform that supports payment by credit cards Visa Mastercard and American Express so you can earn some points or cashback for paying income tax just note that there is a processing.

Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia. Purchase from a person who qualifies for Flat Rate Schemes where. 2 Taxable person means any person who is or is liable to be registered under section 2 GSTA.

An entry should be active within 30 minutes. There are goods and service or importation of goods may be denied to claim their credit. In one of the examples in the PR IRB explained that the company could have.

The goods or services are supplied to you or imported by you. Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods collected by Singapore Customs as well as nearly all supplies of goods and services in Singapore. Generate GAF 45.

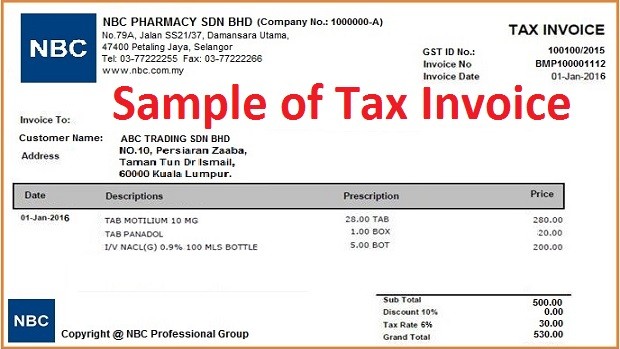

Configure Malaysia GST 9 42. In the absence of a tax invoice or valid tax invoice the company is not entitled to claim a deduction by virtue of section 391o of the ITA. Supply or importation of passenger car including lease of passenger car Passenger car is defined as a motor car of a kind normally used on public roads which is constructed or adapted for the carriage of not more than nine passengers inclusive of the.

- We did not find results for. 2 The supply of goods or services relating to repair maintenance and. What is the treatment for the stock in hand which the input tax has not been claimed belongs to the GST registered person who will be a registered manufacturer during the Sales Tax era.

8 June 2017 Page 4 of 38 regarded as making a taxable supply and is eligible to claim GST paid or to be paid on goo ds and services acquired or imported by him input tax. GST is collected by the businesses. - We did not find results for.

The Tenant AllowBlock List allows a maximum of 500 entries for senders 500 entries for URLs 500 entries for file hashes and 1024 entries for spoofing spoofed senders. At this point in time the rate may be slightly higher. Malaysia GST - Blocked Input Tax.

Property tax 62 Tax on unused land 63 Registration tax transfer tax stamp duty 46. GUIDE ON INPUT TAX CREDIT As at 4 JANUARY 2017. Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the Special Areas.

Accommodaoti n tax 68 Advance tax on dividend distribution 69 Import and export duties. GST Processor 40 91. You scan documents with your camera contact tax experts for help use multiple.

Run GST Processor using wizard 40 92. Standard-rated supplies are goods and services that are charged GST with a standard rate. The maximum number of characters for each entry is.

Conditions for claiming input tax. Which would be taxable supplies if made in Malaysia. Input Tax 6 Capital Goods Acquired To Make Taxable Supplies.

Setting Default Tax Code 13 a Setting Default Tax Code in general 13 b Setting Default Tax Code by Stock Item 14. ITC being the backbone of GST and there are many condition to claim ITC on any items. S38 12 GST Act.

When a company chooses not to claim input tax credit due to administrative reasons eg. Under GST businesses are allowed to claim GST incurred on purchase of most goods and services. The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6.

File hashes 64. A list of No Input Tax Credit. Under section 8 of the Sales Tax Act 2018 sales tax is charged and levied on all taxable goods.

Malaysia Gst Blocked Input Tax Credit Goods And Services Tax

Fiori App Library List Tutorial S 4hana Sap Blogs

List Of Business Expenses On Which Input Vat Is Blocked

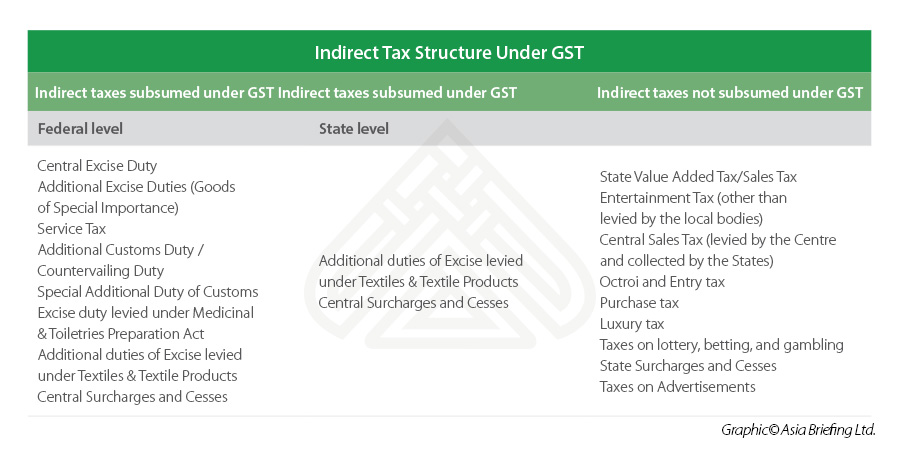

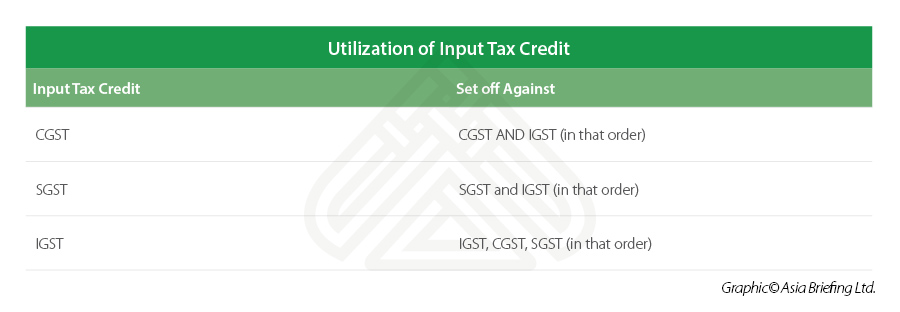

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

Procuring Service From Foreign Providers Here S An Additional 6 Tax Accountants Today

List Of Business Expenses On Which Input Vat Is Blocked

What Is Gst In India Tax Rates Key Terms And Concepts Explained India Briefing News

What Is Blocked Input Tax Credit In Gst Goods Services Tax Gst Malaysia Nbc Group

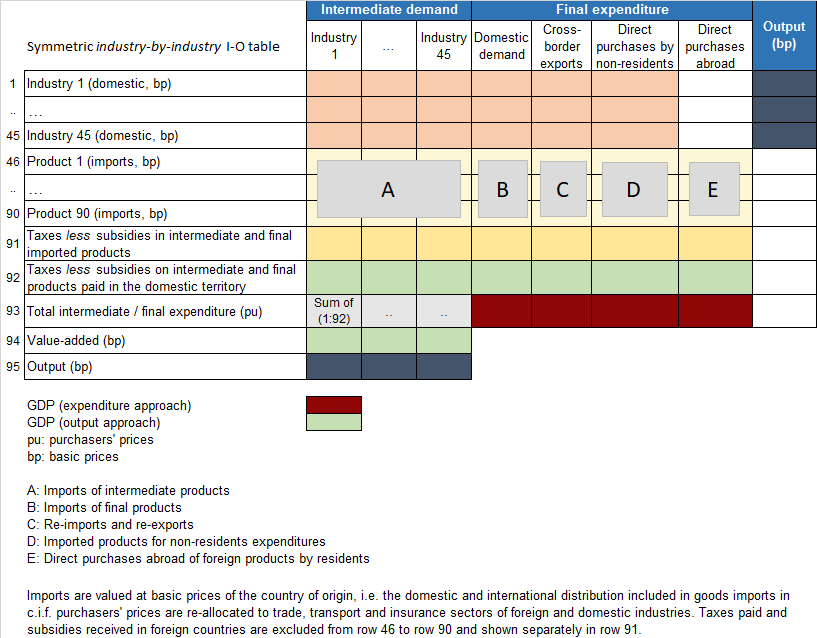

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Administering The Value Added Tax On Imported Digital Services And Low Value Imported Goods In Technical Notes And Manuals Volume 2021 Issue 004 2021

Fiori App Library List Tutorial S 4hana Sap Blogs

Sap Query Browser List Of All Analytical Queries Views In S 4 Hana 2020 Sap Blogs